By reducing retained earnings, dividends can lower the equity base, potentially inflating the ROE. Investors and analysts must consider these ratios in the context of the company’s overall strategy and industry norms. The income statement, which reports a company’s revenues and expenses over a period, is not directly affected by dividend transactions, as dividends are not considered an expense but a distribution of earnings. However, the lower retained earnings figure indirectly indicates to investors and analysts the portion of profit that has been distributed as dividends.

Entries for Cash Dividends

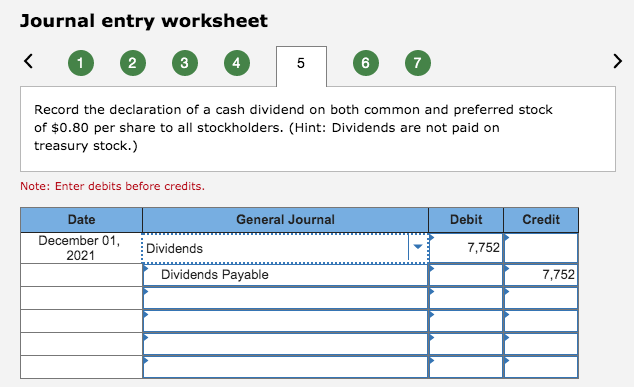

The cash dividend declared is $1.25 per share to stockholders of record on July 1, (date of record), payable on July 10, (date of payment). This has the effect of reducing retained earnings while increasing common stock and paid-in capital by the same amount. Journalizing the transaction differs, depending on the number of shares the company decides to distribute. To record the declaration of a dividend, you will need to make a journal entry that includes a debit to retained earnings and a credit to dividends payable.

Cash Dividend: Explanation

Large stock dividends do not result in any credit to additional paid-up capital. When a company issues cash dividends, it is distributing a portion of its profits in the form of cash to its shareholders. The accounting for cash dividends involves reducing the company’s cash balance and retained earnings. The initial declaration entry, as previously discussed, does not affect the cash balance immediately but does reduce retained earnings to reflect the pending payout.

The Accounting Treatment of Dividends

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. As this excerpt indicates, the management at General Electric Company has given considerable thought to the amount and timing of dividends. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

This journal entry is made to eliminate the dividends payable that the company has made at the declaration date as well as to recognize the cash outflow that is not an expense. The declaration date is the date on which the board of directors declares the dividend. On that date the current liability account Dividends Payable is debited and the asset account Cash is credited. If the corporation’s board of directors declared a cash dividend of $0.50 per common share on the $10 par value, the dividend amounts to $50,000. Dividends Payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders that are generally fulfilled within one year. Dividends represent a critical aspect of corporate finance, serving as a means for companies to distribute profits back to shareholders.

- Understanding these differences is crucial for accurate financial reporting and analysis.

- The accounting for cash dividends involves reducing the company’s cash balance and retained earnings.

- The amounts within the accounts are merely shifted from the earned capital account (Retained Earnings) to the contributed capital accounts (Common Stock and Additional Paid-in Capital).

- Dividends are typically disclosed in the statement of changes in equity, where they are shown as a deduction from retained earnings.

- The key difference is that small dividends are recorded at market value and large dividends are recorded at the stated or par value.

Cash Flow Statement

He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Any net income not paid to equity tax form 1099 holders is retained for investment in the business. The subsequent distribution will reduce the Common Stock Dividends Distributable account with a debit and increase the Common Stock account with a credit for the $9,000. Cynthia Gaffney has spent over 20 years in finance with experience in valuation, corporate financial planning, mergers & acquisitions consulting and small business ownership.

However, sometimes the company does not have a dividend account such as dividends declared account. This is usually the case in which the company doesn’t want to bother keeping the general ledger of the current year dividends. To illustrate, assume that Duratech Corporation’s balance sheet at the end of its second year of operations shows the following in the stockholders’ equity section prior to the declaration of a large stock dividend.

When investors receive a stock dividend, the cost per share of their original shares is reduced accordingly. The final entry required to record issuing a cash dividend is to document the entry on the date the company pays out the cash dividend. GAAP is telling everyone that once dividends are declared, instantly the money is owed. The company is liable for the dividends and you recognize or record the liability. The first step in recording the issuance of your dividends is dependent on the date of declaration, i.e., when your company’s Board of Directors officially authorizes the payment of the dividends.

If a balance sheet date intervenes between the declaration and distribution dates, the dividend can be recorded with an adjusting entry or simply disclosed supplementally. Accounting practices are not uniform concerning the actual sequence of entries made to record stock dividends. If there are more shares, then less money is distributed per share, and vice versa if there fewer shares outstanding.